Environmental, Social and Governance Investing

Our primary objective as wealth managers is to design investment portfolios that meet each client’s goals, while mitigating undue risks. We manage risks in a portfolio primarily through asset allocation and fundamental analysis (research and forecasting of a company’s business model, sales, earnings, and balance sheet) with an aim to uncover high-quality businesses trading at reasonable valuations.

What Is ESG and Impact Investing?

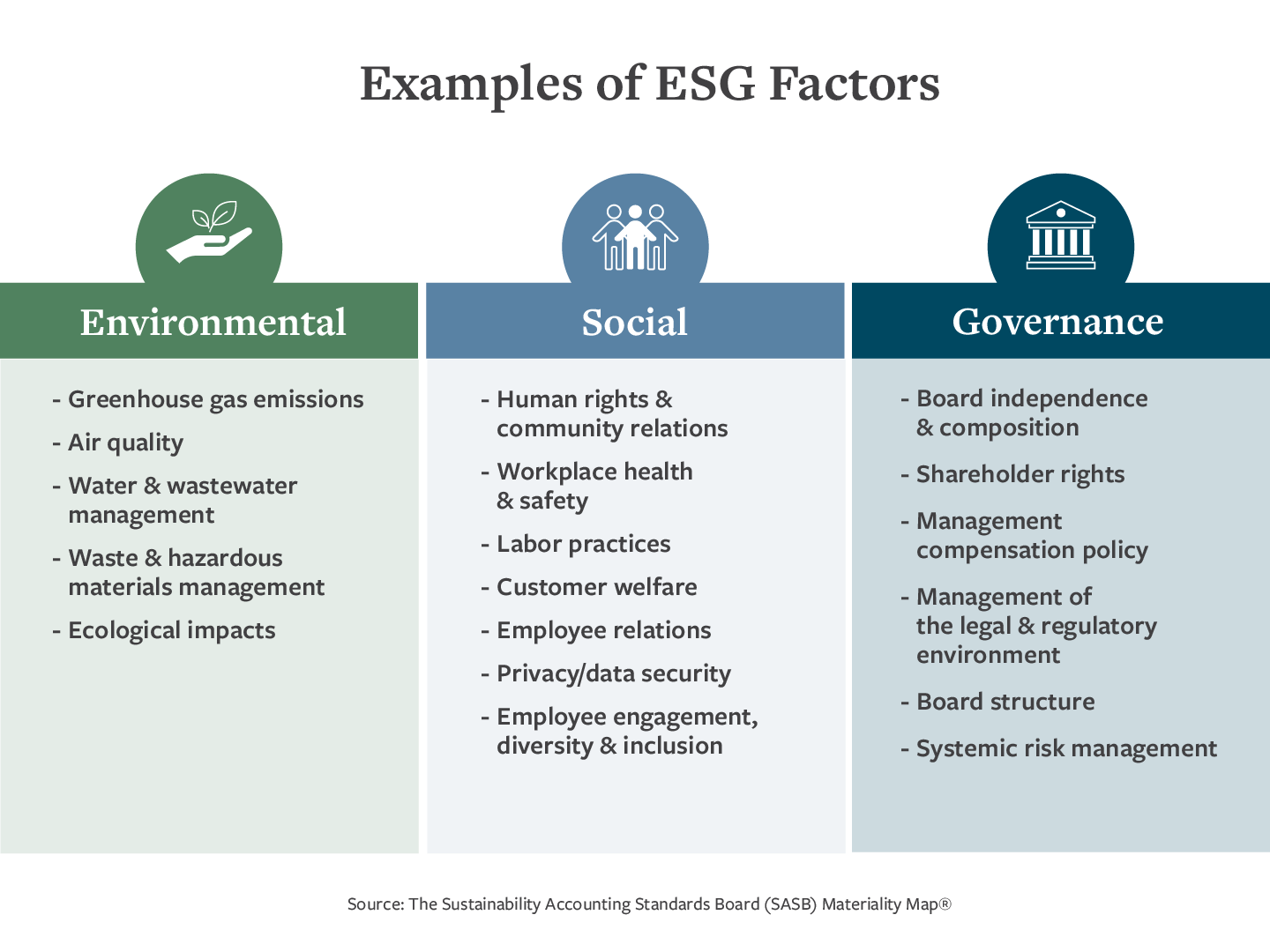

Our analysis also includes non-financial factors, commonly referred to as environmental, social and governance (ESG) factors, to help identify both risks and opportunities. ESG is often used interchangeably with the term impact investing; however, there is a distinction. Investors may consider ESG factors when evaluating decisions taken by company management that affect operational efficiency and future strategic direction. Investors seeking to invest more thematically in companies that are proactively solving some of society’s most pressing issues are considered to be implementing impact investing; these investors are typically, but not always looking at ESG factors.

Our Approach

ESG analysis has become an increasingly important part of our diligence process as a way to garner a more comprehensive understanding of the companies in which we invest, with a focus on factors including reputational risk, regulatory developments, or megatrends, such as climate change/price of carbon. This approach is supported by academic research that confirms that evaluating material non-financial factors contributes to performance and mitigation of risk. The level of emphasis that we give to this form of analysis depends on client interests and goals. In the past, client conversations were centered around divestment—this was due to the fact that, less than ten years ago, data relating to ESG factors was much less sophisticated than it is today. Much of the data available focused on exclusionary factors, such as controls and policies in place; examples include those to mitigate cluster munitions, bribery and corruption, or child labor. Today we have access to broader and more sophisticated data. While there is still no "one size fits all" answer, standards, guidelines, scores, stewardship codes, screens, and ratings are available and add tangible value to the investment decision making process.

As a firm, we have added to our ESG research capabilities by investing in new analytical tools and an investment professional with an ESG background. We have always favored companies offering safe, reliable products with strong management teams and we find the additional steps we’ve taken are complementary to our traditional fundamental approach to investing.

Customizing Client Portfolios to Meet Individual Values and Priorities

A key difference in our approach to ESG and impact investing is that we structure each client’s portfolio according to that client’s values and priorities for environmental, social and governance concerns. In addition, for those clients for whom it is appropriate, we are available to discuss impact investments designed to support companies, often private, that are developing novel approaches and solutions to some of society’s most challenging problems.

Meet HTC's Head of Sustainable Investing

Eileen M. Durey, CFP®

Eileen Durey is a Senior Investment Officer and the Head of Sustainable Investing at Hemenway Trust Company. She develops tailored investment strategies for high net worth individuals, families, foundations, and endowments.