Market Update: 2024 in Review

2024 in Review: A Bull Run, AI Frenzy, and What’s Next

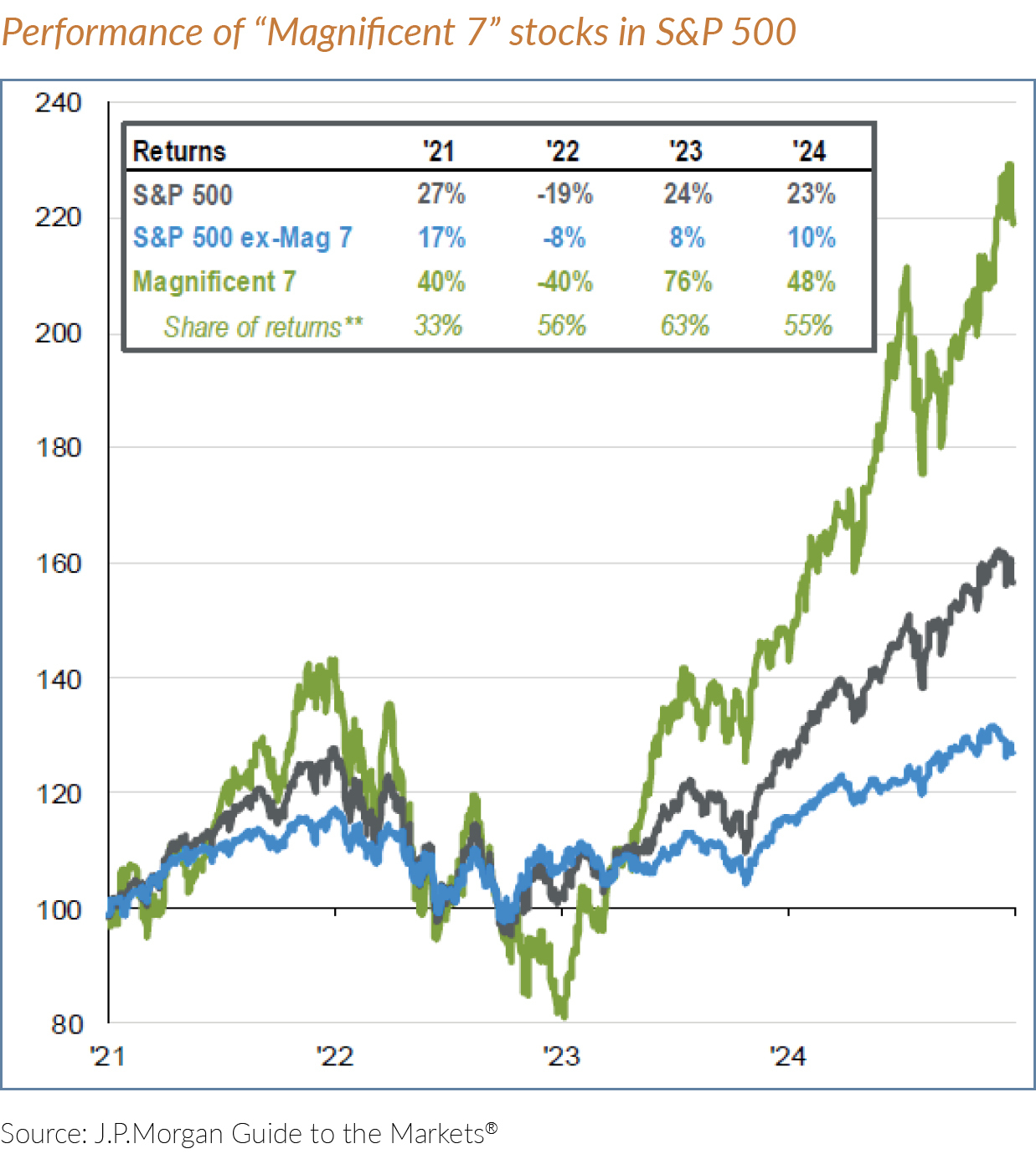

Last year was a surprise to most economists as the U.S. economy maintained robust growth and employment, and saw a gradual decline in inflation, despite the highest interest rates since 2007. This positive economic environment, coupled with strong earnings from the technology sector and widespread excitement around advancements in artificial intelligence (AI), led the S&P 500 to return 25% for the year. Over half of that extraordinary return came from just seven stocks* in the cap-weighted S&P. On an equal-weight basis, the S&P 500 returned 13% in 2024, a strong and more rational outcome.

Can the Bull Keep Running?

After two consecutive years of 20%+ returns for the index, there are questions around whether the bull market will – or can – persist for much longer. While our long-term investment lens does not seek to forecast returns over the next year, we do see a positive backdrop for the U.S. economy and many Fortune 500 companies maintaining their dominant positions and high profit margins over the near-term.

The S&P 500 is currently trading around 22x next year’s projected earnings. While this valuation is well above historical averages, we believe it’s supported by projections of double-digit earnings growth and near-record profit margins. That said, given the high expectations, there is little margin for error.

Higher-than-Expected Bond Returns

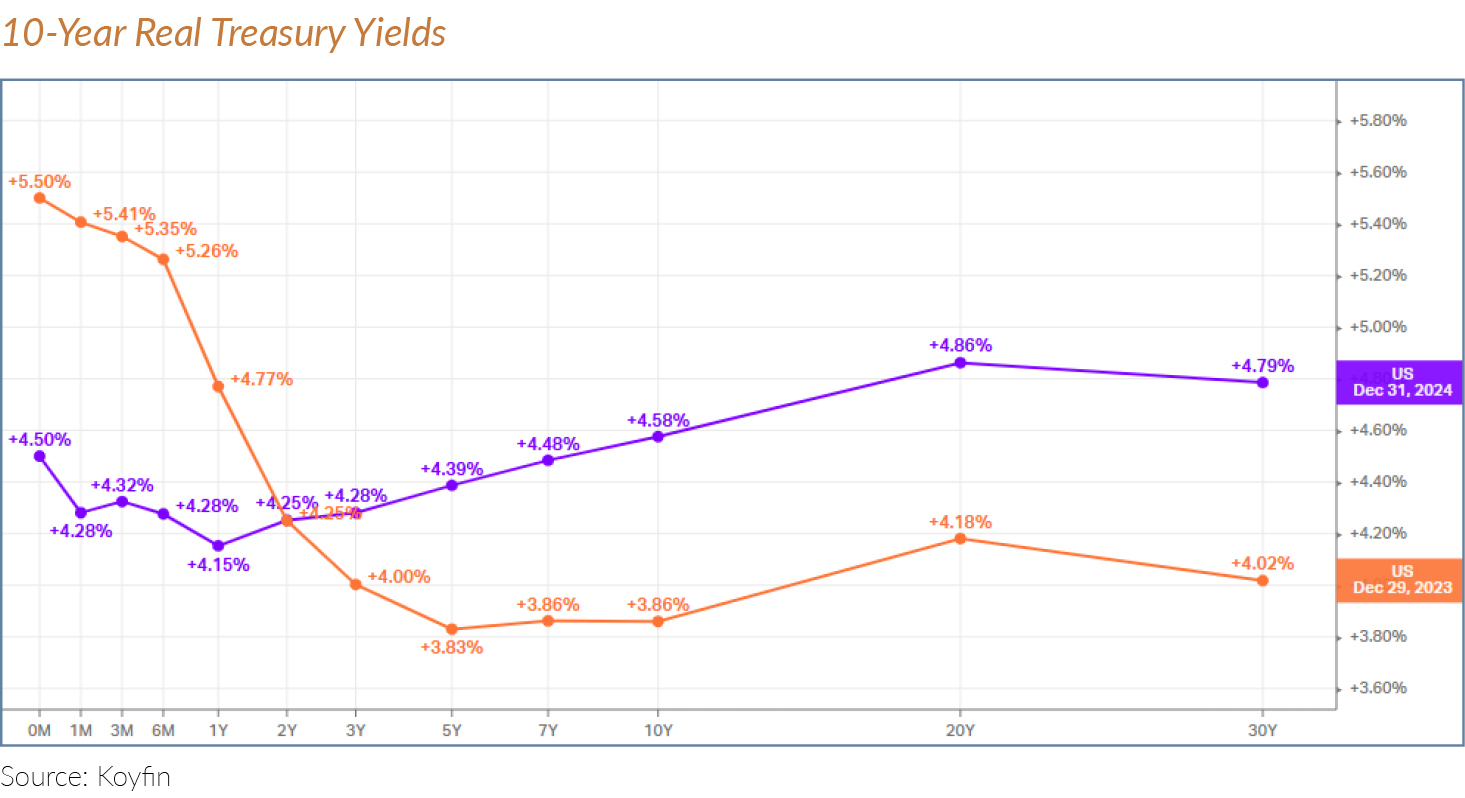

The bond market also saw its share of surprises last year. As the economy performed well in 2024, the Federal Reserve delayed its plan for rate cuts. When they eventually cut interest rates by 1% at the end of the year, the 10-year Treasury yield rose almost 0.7%, where we would typically see yields on long-term bonds decrease after rate cuts.

Perhaps the main reason behind this surprising turn: The bond market has become increasingly worried about rising U.S. deficits, as we saw the Treasury issuance increase by almost 30% in 2024 (totaling $29.3 trillion). This increased supply of bonds is making it harder to find buyers – especially when central banks outside the U.S. are dealing with their own debt issues and investors are favoring stocks over bonds due to their outperformance over the last two years.

In response, we’ve been taking advantage of the higher bond yields by slowly adding intermediate, high-quality bonds with annual returns of +4.5%. These purchases have been funded through a combination of profits from high-valuation stocks and a reduction in our money market holdings.

The International Landscape

Outside the U.S., 2024 was a more challenging picture. China’s economy continues to grapple with a sluggish domestic market, a deflating real estate bubble, and escalating trade tensions with the U.S. Europe also continues to experience subpar growth with rising energy prices, impacting both consumers and the continent’s vital manufacturing sector.

While we maintain a preference for U.S. stocks, we continue to look for investment opportunities outside the U.S. in high-quality companies with growing global revenue streams trading at a healthy discount.

AI Boom or Bubble?

Artificial intelligence (AI), machines with the ability to perform tasks that typically require human intelligence, has evolved over the past decades. Breakthroughs in the 2000s were driven by an explosion of data from the internet, social media, and digital transactions, coupled with advances in computing power and affordable storage. This technological progress led to deep learning, which uses artificial neural networks to mimic the human brain and identify complex patterns across vast datasets.

More recently, generative AI has emerged as a game-changer, enabling machines to not only process data but also to generate text, images, and code with remarkable speed and sophistication. While much of this work was done behind the scenes in the tech sector, the public debut of ChatGPT in late 2022 brought the power of generative AI into the spotlight and ignited a race among major tech firms and governments to invest in AI infrastructure, including significant investments in advanced semiconductor chips, data centers, and the energy infrastructure required to support them.

Tech companies began selling tools rather than end-user AI products, a move that mirrors historical tech cycles like the cloud and mobile eras. Coming into this year, analysts were questioning whether capital expenditure projections could justify current valuations, especially as competition intensifies. And just recently, the release on DeepSeek, a Chinese open-source large language model (LLM) made global waves with the release of its R1 model. The model delivers performance comparable to leading LLMs, but was developed at a fraction of the cost with remarkable speed to market.

Overall, we believe DeepSeek’s launch of R1 is a positive step for the AI ecosystem, offering an opportunity for wider proliferation of powerful AI technologies and fostering innovation by empowering researchers and entrepreneurs alike.

Tech giants like Amazon, Google, Meta, and Microsoft have led AI investments, driving demand for NVIDIA’s advanced chips. With the profits generated from selective sales of these stocks, we have taken the opportunity to diversify client portfolios. This includes investing in “picks and shovels” companies that provide energy-efficient technologies for data centers (the backbone of the digital world), such as building automation, HVAC systems, smart grid technology, and industrial energy management software. These data centers consume significant energy, primarily for IT and cooling equipment. We’re also increasing our holdings in software companies, who have invested aggressively in AI and are starting to see profits from investment in these initiatives.

As AI continues to evolve, its impact on industries and society at large is expected to grow exponentially, reshaping the technological landscape and opening new frontiers of innovation.

Our Perspective

Of course, no review of Q4 and the year ahead would be complete without noting President Trump’s return to the White House. We write amidst a whirlwind of activity in the early days of a second Trump presidency. Having focused his campaign on issues including immigration, inflation, international trade, and the United States’ role in the world, President Trump has a slim majority in the House, with a larger advantage in the Senate. Whether and to what extent the legislative branch will act in the days ahead remains to be seen. In addition, we can expect that an independent judiciary will continue to play a critical role in placing checks and balances on the power of both the executive and legislative branches of our three-part national government. Just how investors and the markets will respond remains to be seen, but we know from experience that markets have done well and less well, no matter what party is in control in Washington. We will maintain our core principles in doing the work we do, a discipline that has served us well over many a market and election cycle.

As we reflect on the past two years of strong market performance, it’s important to temper expectations for a third consecutive year of well-above-average returns. History shows that returns after such periods are generally followed by below-average returns (4% on average). The instances that buck this trend were extraordinary periods, from the roaring 1920s to the late 1990s. These historical trends remind us that, while past performance sets a high bar, it doesn’t guarantee continued strength.

In line with our core investment philosophy, we will continue managing client portfolios with a focus on preserving capital and enhancing both income and capital growth, all within a client-specific context. Our strategy emphasizes a balanced approach, incorporating high-quality equities, maintaining bond and cash positions, and carefully evaluating new investment opportunities.

These decisions will vary by account, based on investment goals, risk tolerance, and tax implications. As always, please let us know if you would like a detailed review of your portfolio.