Market Update: Q1 2025

Key Takeaways

- The U.S. announcement of massive new tariffs on foreign goods has led to fears of a recession.

- U.S. equity markets have been hit the hardest with investors questioning the U.S. exceptionalism and safe-haven status.

The Macro Analysis

After a strong start to 2025—with stocks and bonds up in January—U.S. equities lost momentum in March, as economic data revealed a slowdown in consumer spending. This was compounded by cautious commentary from retailers regarding the health of U.S. consumers, who had largely remained resilient over the past three years of higher inflation. Adding to the unease were mounting fears that potential U.S. tariffs on foreign goods could trigger stagflation, a trap characterized by simultaneous increases in inflation and decreases in growth.

Before the tariff announcement on April 3, the University of Michigan’s consumer sentiment index declined for the fourth consecutive month, hitting a 12-year low. When President Trump announced universal and reciprocal tariffs, which were far larger than anyone had expected, equity markets immediately sold off 10%, with some consumer stocks selling off more than 30%. Stocks continued their decline as China announced retaliatory tariffs, though markets have partially rebounded following the U.S. decision to pause most tariffs (excluding those on China) for 90 days.

Sector Shifts and Global Reallocation

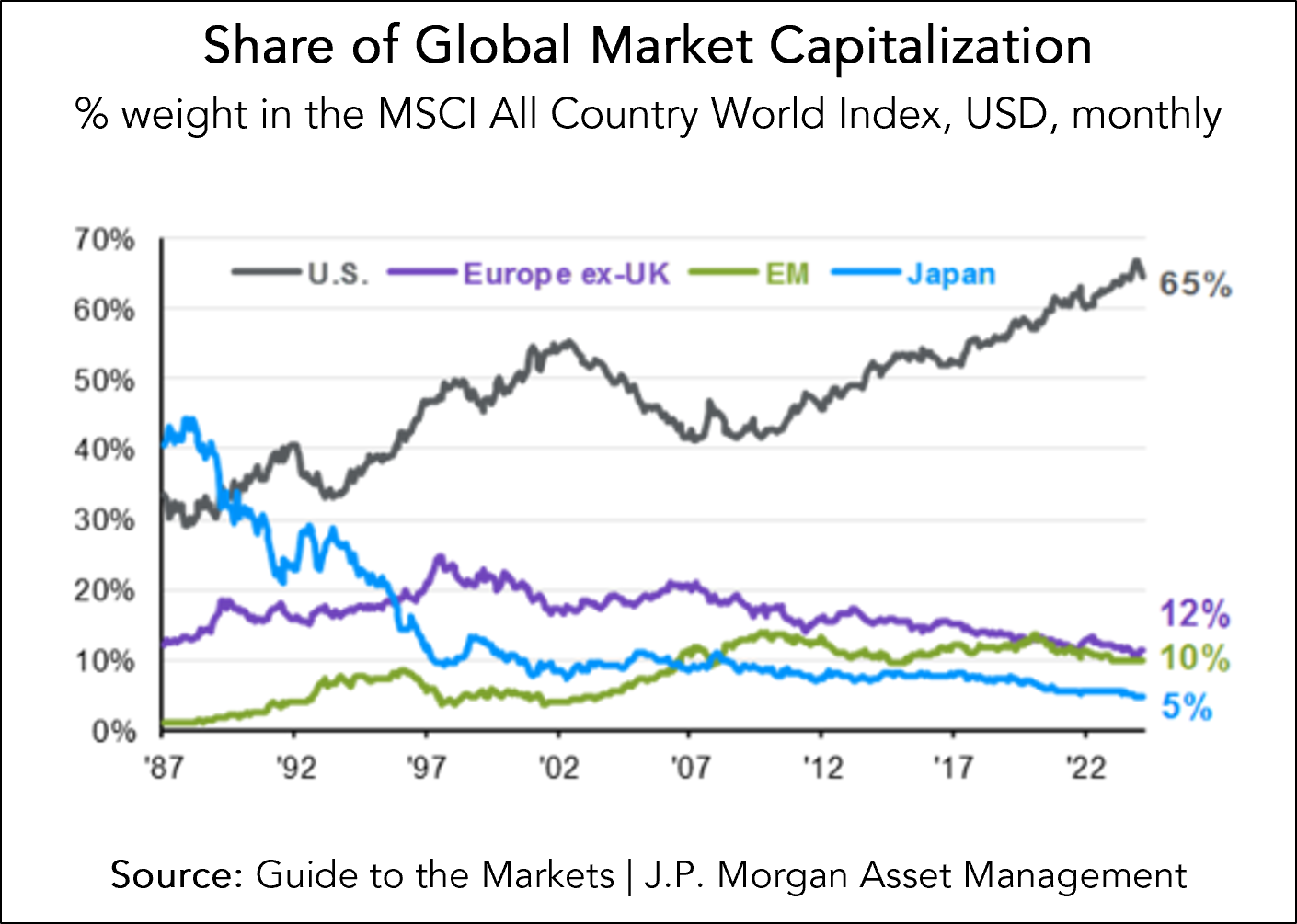

Year-to-date through April 11, the S&P 500 was down 8.5%, with steeper declines in small-cap stocks and growth sectors, particularly technology and retail. Both areas are especially vulnerable to tariffs given their reliance on Asian sourcing/manufacturing and sensitivity to shifts in consumer sentiment and recession fears. In contrast, defensive sectors such, as healthcare, consumer staples, and utilities, have held up well amid the volatility, as investors seek assets with more consistent earnings and cash flows in the near term. Additionally, investors have shifted some investments away from the U.S., even though, as shown in the chart below, it has significantly outperformed over the last 10 years.

U.S. Bond Market

One of the key reasons behind the administration’s decision to pause the implementation of “reciprocal tariffs” was concern that the bond market was becoming unsettled. Typically, market volatility or recession fears drive investors toward safe-haven assets like defensive stocks and government bonds, with U.S. Treasuries considered the safest and most liquid option. However, the new U.S. tariff policy disrupted this perception. Longer-term interest rates—specifically the 10-year and 30-year tenures—have risen sharply amidst escalating trade tensions. The 10-year bond yield jumped 0.5% (from 4.0%) shortly after "Liberation Day."

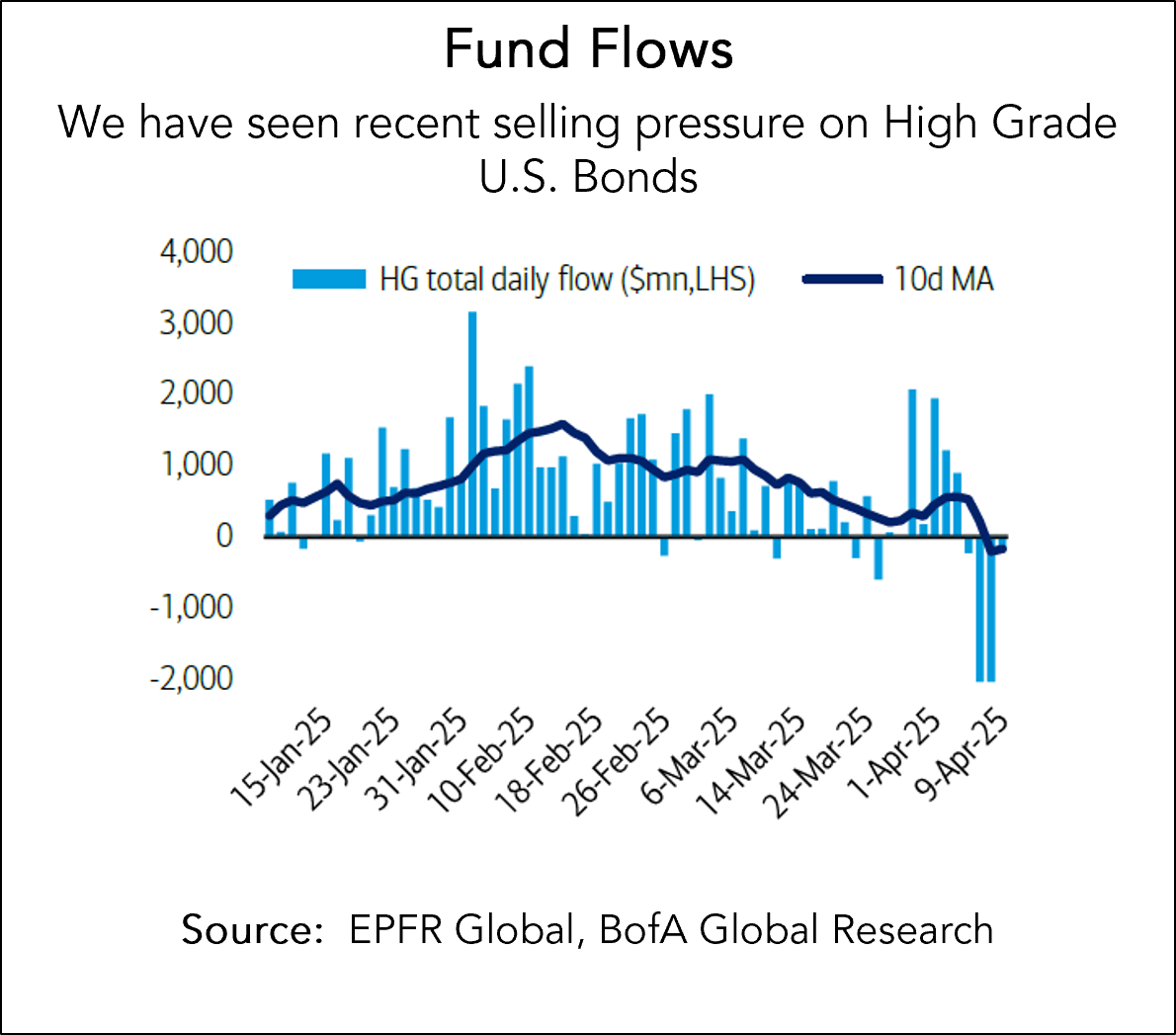

Investors appear increasingly concerned that foreign buyers will reduce their appetite for U.S. debt, especially as >25% of the $27 Trillion of U.S. government debt comes due over the next year. As seen in the Fund Flows chart, we have seen modest selling pressure on U.S. bonds over the short term. Historically, foreign governments have been major buyers of U.S. Treasuries as a way to hedge their currencies against the dollar. But if trade with the U.S. is expected to decline, the need to hold U.S. dollars—and by extension, Treasuries—diminishes.

Economist Ed Yardeni, who coined the term "bond vigilantes" in the 1980s to describe fixed-income investors who sell Treasuries in protest of government policies, recently cautioned that "the Trump administration may be playing with liquid nitro." While the U.S.-China trade conflict remains a key concern, we expect that market forces will compel the administration to deliver a credible economic plan that ensures strong ties to key trading partners, a plan where all parties benefit. We’ve already seen a fair amount of exemptions to tariffs since the initial announcement and expect large multinational companies to be better positioned to navigate a period of higher rates and slower growth.

More on Artificial Intelligence

While tariffs have grabbed most of the headlines, technology stocks—which have driven equity market gains over the past three years—were shaken in Q1 by the emergence of a new artificial intelligence (AI) model from Chinese company DeepSeek. The model caught the tech world off guard with its strong performance, open-source availability, and significantly lower development costs. Despite being funded with far less capital, it showed capabilities comparable to those of large language models backed by major U.S. tech giants.

We believe AI will fundamentally alter productivity across every industry. The increasing volatility of the global economy will likely accelerate the adoption and integration of AI solutions for organizations that seek long-term resilience and growth, far beyond a mere competitive advantage.

One of the most significant advancements in recent years has been the rise of Agentic AI systems—autonomous tools that use step-by-step reasoning to navigate complex and unclear situations without needing detailed instructions. Unlike traditional software, these systems are capable of adapting, making decisions, and solving problems with more nuance. We are encouraged to see many of the core companies we invest in utilizing and testing AI into their business models and expect this to pay dividends in the future.

Healthcare Spotlight

Led by large-cap biopharma, the healthcare sector has outperformed so far in 2025. The sector is at the forefront of a technological revolution offering both stability and growth potential. For investors, opportunities lie in companies that pair strong fundamentals with innovation—whether through AI-driven drug discovery, advanced medical devices, or personalized treatments.

As the healthcare industry continues to transform, we evaluate many factors when making investment decisions, including:

- How AI is streamlining drug discovery, clinical trials, and personalized medicine, reducing costs and accelerating timelines.

- The risks associated with the lengthy development cycles in breakthrough areas like gene therapy and personalized medicine.

- Evaluating established "big pharma" companies as they continue to produce steady returns, particularly as demand grows for specialty drugs, including anti-obesity medications.

- Innovation in diagnostics is fundamentally reshaping the healthcare landscape through increased precision, efficiency, and accessibility.

Long-term tailwinds—including aging populations in developed countries and rising healthcare demand in emerging markets—are driving long-term growth. We have traditionally invested in medical device and diagnostics companies, which not only align with these trends but also offer robust balance sheets and strong cash flows. Valued for its resilience during market downturns and its essential role in everyday life, healthcare remains a cornerstone of our investment strategy.

Our Perspective

The ongoing lack of clarity surrounding trade, fiscal, monetary, and other policies has introduced a broad spectrum of potential economic outcomes, with an increasing tilt toward downside risks. This uncertainty poses significant challenges for investors. In response, we remain focused on identifying companies with solid financial foundations and resilient business models capable of navigating diverse economic conditions. As always, we aim to steer clear of investments in companies whose valuations are based on overly ambitious growth assumptions.

Furthermore, we continue to advocate for holding high-quality bonds within multi-asset portfolios, as they serve as a vital stabilizing force ("portfolio ballast"), while also providing attractive income yields. In light of the rapid pace of economic developments and policy shifts, heightened market volatility is likely to remain a defining feature of the current investment environment.